The Difference a Year Makes for Homeownership

Over the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here is a look at three of them.

1. Move-up or Downsize: One option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that is truly a perfect fit, especially if your lifestyle has changed this year.

2. Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a truly incredible time to buy if you’re considering it. Just take a look at the cost of renting vs. buying.

3. Refinance: If you already own a home, you may decide you’re going to refinance. This is one way to lock in a lower monthly payment and save more over time. However, it may also mean paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home? If the answer is yes, let us know so we can connect you with some exceptional mortgage lenders.

Why 2020 Was a Great Year for Homeownership

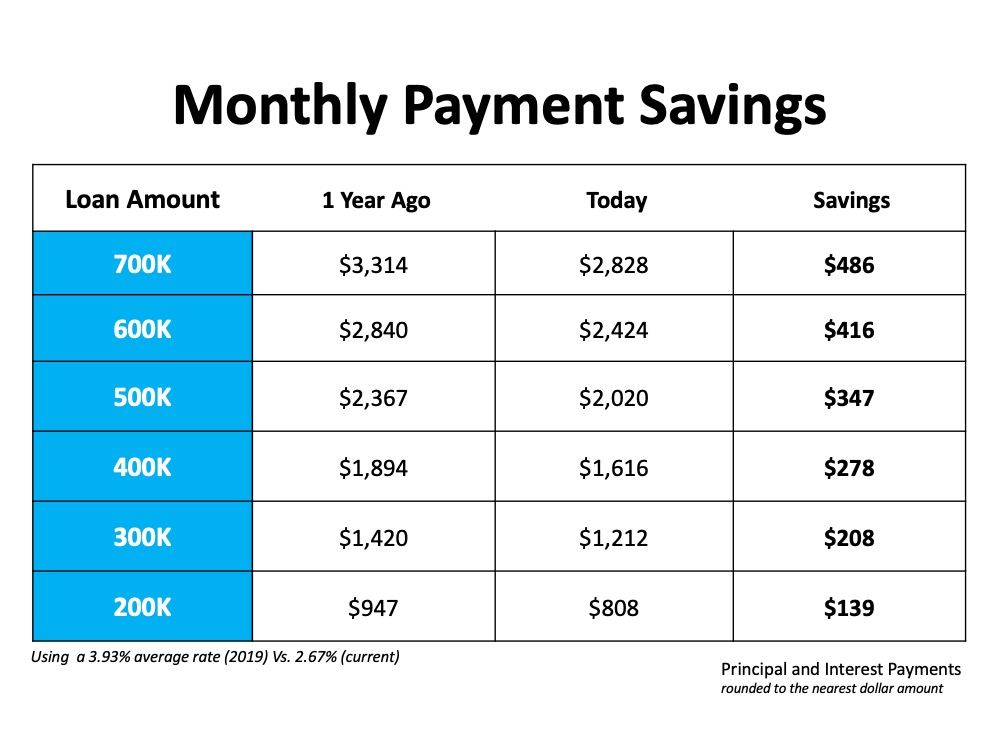

Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance:

Bottom Line

If you’ve been waiting since last year to make your move into homeownership or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the ball rolling. Let’s connect to discuss how you may benefit from the current rates, making your hopes of moving a reality.

Before You Go

Here are some links to help you search the newest Twin Cities listings, find the hottest “Coming Soon” homes, see your current home value, read our mesmerizing blog, or contact us with any questions. We’re here to be your guide and always happy to help.

Categories

![How to Prepare Your House for a Winning Sale This Spring [INFOGRAPHIC]](https://files.mykcm.com/2021/03/04132426/20210305-MEM-1046x2324.png)