How Smart Is It to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.

However, there is one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate. You just need to ask yourself two questions:

- Do I think home values will be higher a year from now?

- Do I think mortgage rates will be higher a year from now?

From a purely financial standpoint, if the answer is ‘yes’ to either question, you should strongly consider buying now. If the answer to both questions is ‘yes,’ you should definitely buy now.

Nobody can guarantee what home values or mortgage rates will be by the end of this year. The experts, however, seem certain the answer to both questions above is a resounding ‘yes.’ Mortgage rates are expected to rise and home values are expected to appreciate rather nicely.

What does this mean to you?

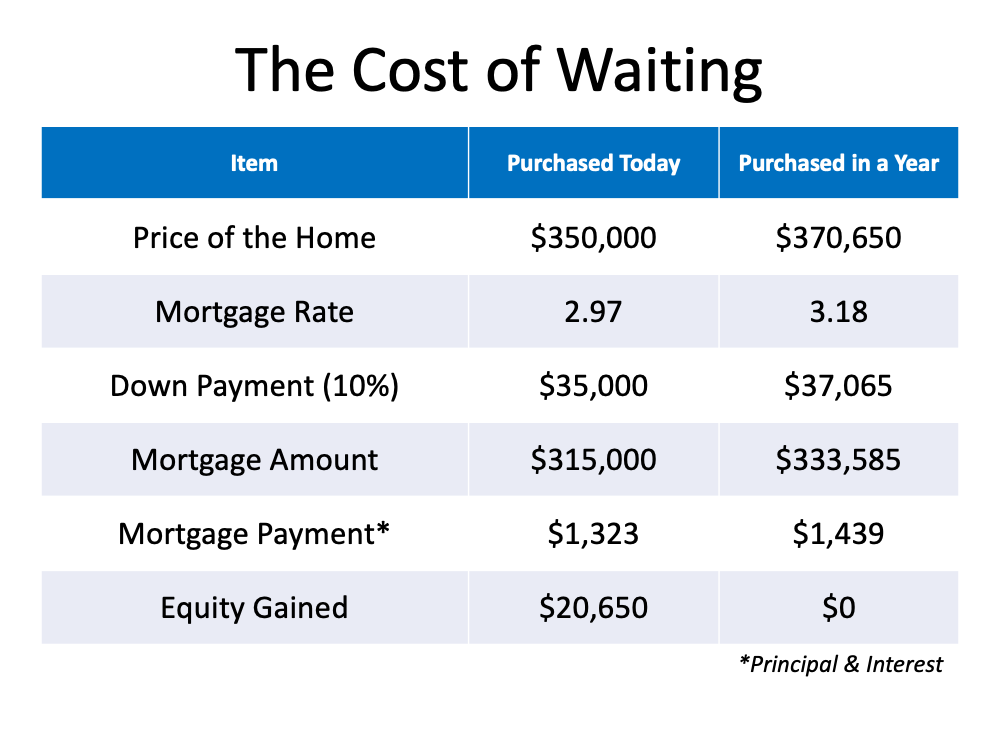

Let’s look at how waiting would impact your financial situation. Here are the assumptions made for this example:

- The experts are right – mortgage rates will be 3.18% at the end of the year

- The experts are right – home values will appreciate by 5.9%

- You want to buy a home valued at $350,000 today

- You decide on a 10% down payment

Here is the financial impact of waiting:

- You pay an extra $20,650 for the house

- You need an additional $2,065 for a down payment

- You pay an extra $116/month in your mortgage payment ($1,392 additional per year)

- You do not gain the $20,650 increase in wealth due to the lost equity build-up

But aren’t home values too high?

No, in fact, they are right where they should be if you trust math. The chart below from the Minneapolis Area Association of Realtors shows the average residential sale price for the Twin Cities metro area going back to 1960. As you can see, even with the recent increase in home values, locally we are still in line with the historical average appreciation rate – even slightly below average.

This should give you confidence that even with recent price increases, the opportunity that still exists to buy when interest rates are so low is something that should not be overlooked. As the chart below from the Saint Paul Area Association of Realtors indicates, current interest rates make the affordability nearly identical to what it was two years ago. This means you can purchase now, after two years of incredible increases in value, and still pay nearly the same for a median priced home as you would have two years ago.

Bottom Line

There are many things to consider when buying a home. However, from a purely financial aspect, if you find a home that meets your needs, buying now makes much more sense than waiting.

Before You Go

Here are links to help you search the newest “Active” Twin Cities listings, find the hottest “Coming Soon” listings, check out your current home value, read more of our mesmerizing blog posts, or contact us with any questions.

Categories

![How to Prepare Your House for a Winning Sale This Spring [INFOGRAPHIC]](https://files.mykcm.com/2021/03/04132426/20210305-MEM-1046x2324.png)